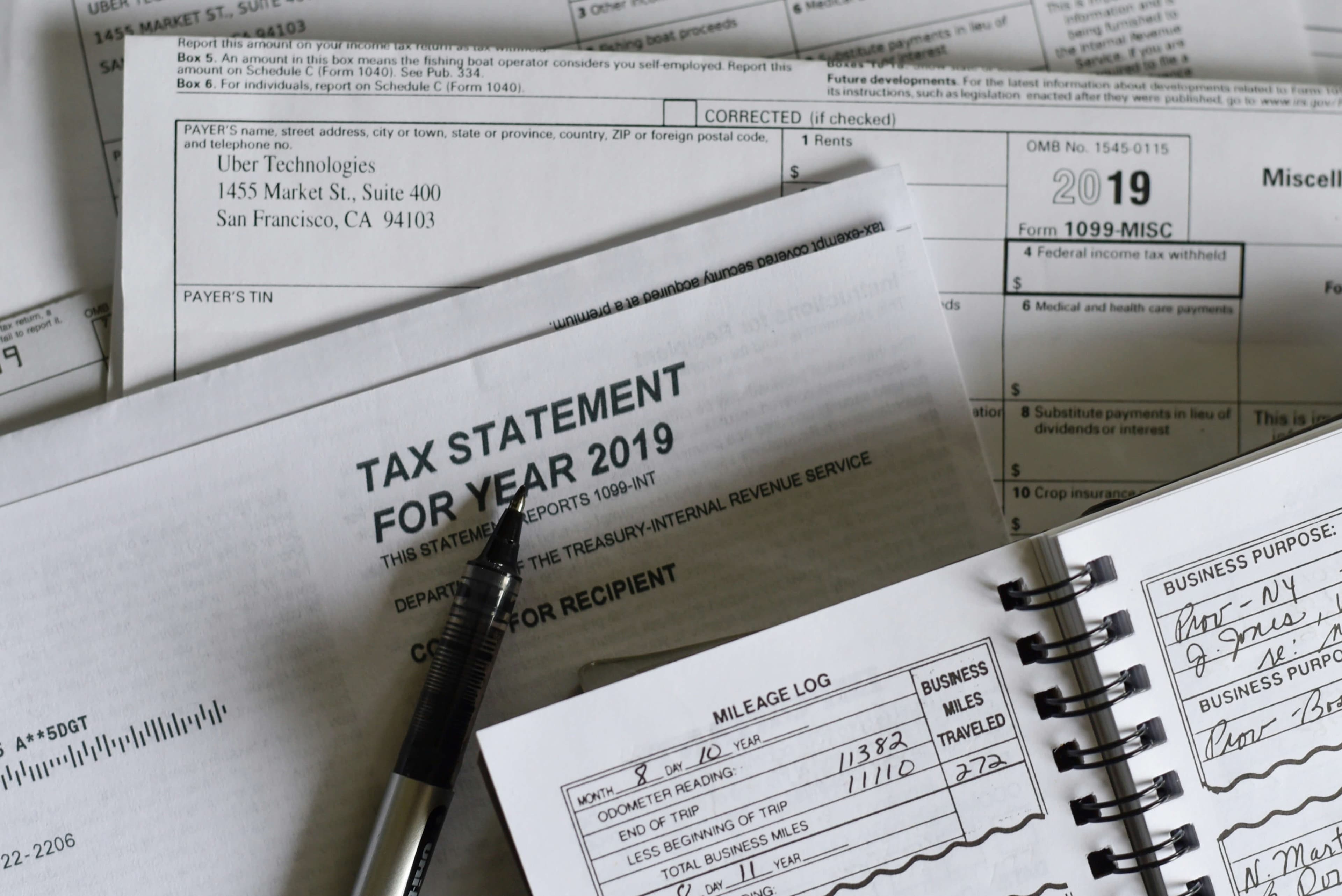

Tax Preparation

Comprehensive tax return preparation for individuals and businesses with maximum deductions.

Professional Tax Preparation

Our tax preparation services are designed to ensure you maximize your deductions while remaining fully compliant with all tax laws. We handle tax returns for individuals, small businesses, corporations, partnerships, and non-profit organizations.

Our Tax Preparation Services Include:

- Individual tax return preparation

- Business tax return preparation

- Estate and trust tax preparation

- Tax return review and second opinions

- Amended tax returns

- Back taxes and unfiled returns

The Benefits of Tax Preparation

Maximized Deductions

We identify all legitimate deductions to minimize your tax liability.

Stress Reduction

Let our experts handle complex tax forms and calculations so you don't have to.

Audit Protection

Professional preparation reduces audit risk and provides support if you are audited.

Time Savings

Focus on what matters most while we handle the time-consuming tax preparation process.

Our Process

- 1

Information Gathering

We collect all necessary financial documents and information.

- 2

Tax Analysis

We analyze your financial situation to identify all possible deductions and credits.

- 3

Preparation & Review

We prepare your returns with careful attention to detail and thorough review.

- 4

Filing & Documentation

We file your returns electronically and provide you with complete documentation.